st louis county sales tax rate 2020

2020 rates included for use while preparing your income tax. The sales tax jurisdiction.

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

This rate includes any state county city and local sales taxes.

. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

There is no applicable county tax or special tax. What is the sales tax rate in Saint Louis Missouri. This rate includes any state county city and local sales taxes.

What is the sales tax rate in St Louis County. Missouri has a 4225 sales tax and St Louis County collects an. Over the past year there have been 153 local sales tax rate changes in Missouri.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Illinois has 1018 cities counties and special districts that collect a local sales tax in addition to the Illinois state sales taxClick any locality for a full breakdown of local property taxes or visit. State Rate County City Rate Total Sales.

The latest sales tax rate for Saint Louis Park MN. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. 012020 - 032020 - PDF.

This is the total of state and county sales tax rates. The latest sales tax rate for Saint Louis County MO. The Missouri state sales tax rate is currently.

Statewide salesuse tax rates for the period beginning January 2020. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax. Minnesota has a 6875 sales tax and St Louis County collects an.

Average Sales Tax With Local. This is the total of state county and city sales tax rates. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Statewide salesuse tax rates for the period beginning February 2020. 2022 List of Missouri Local Sales Tax Rates. This is the total of state and county sales tax rates.

2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax. The minimum combined 2022 sales tax rate for St Louis County Minnesota is.

This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for St Louis County Missouri is. The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special.

The latest sales tax rate for Saint Louis MO. The total sales tax rate in any given location can be broken down into state county city and special district rates. St louis county sales tax rate 2020 Saturday May 7.

Fourth Quarter 2020 Taxable Sales Nextstl

Missouri Sales Tax Rates By City County 2022

Filing A Missouri State Tax Return Things To Know Credit Karma

Construction Set To Begin On Long Awaited Police Precinct In South County St Louis Call Newspapers

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

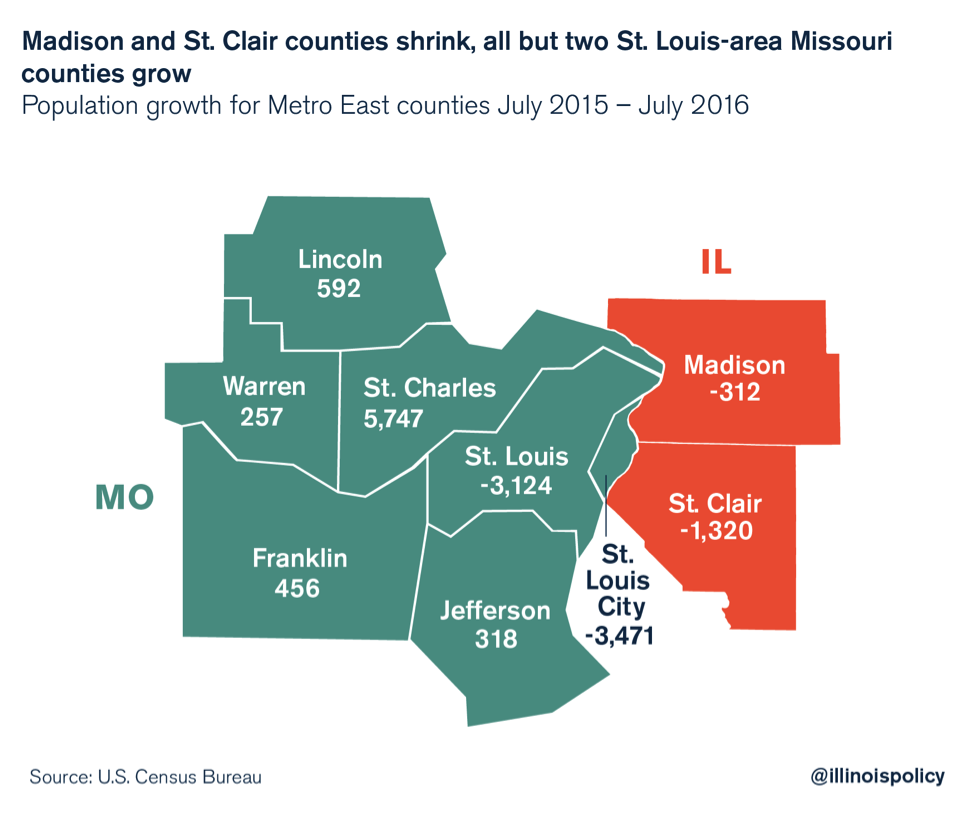

Census Estimates Show St Louis Population Falling Again Show Me Institute

Missouri Income Tax Rate And Brackets H R Block

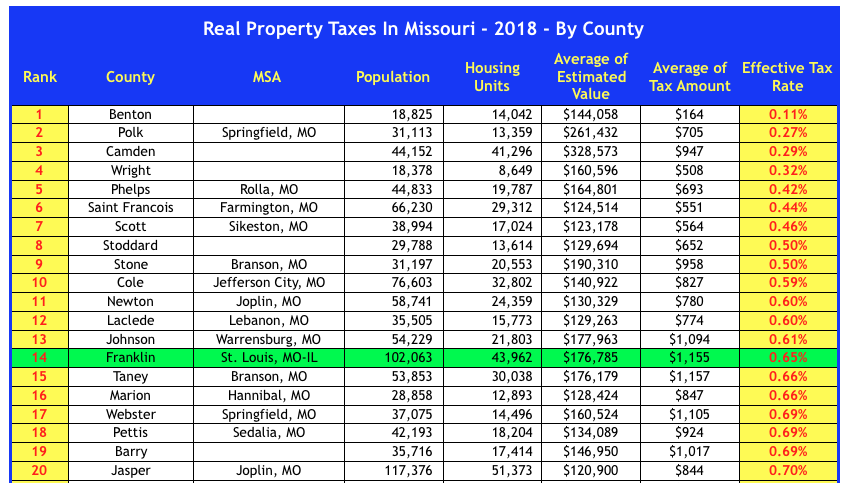

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Missouri Partnership Economic Development Location Low Business Costs

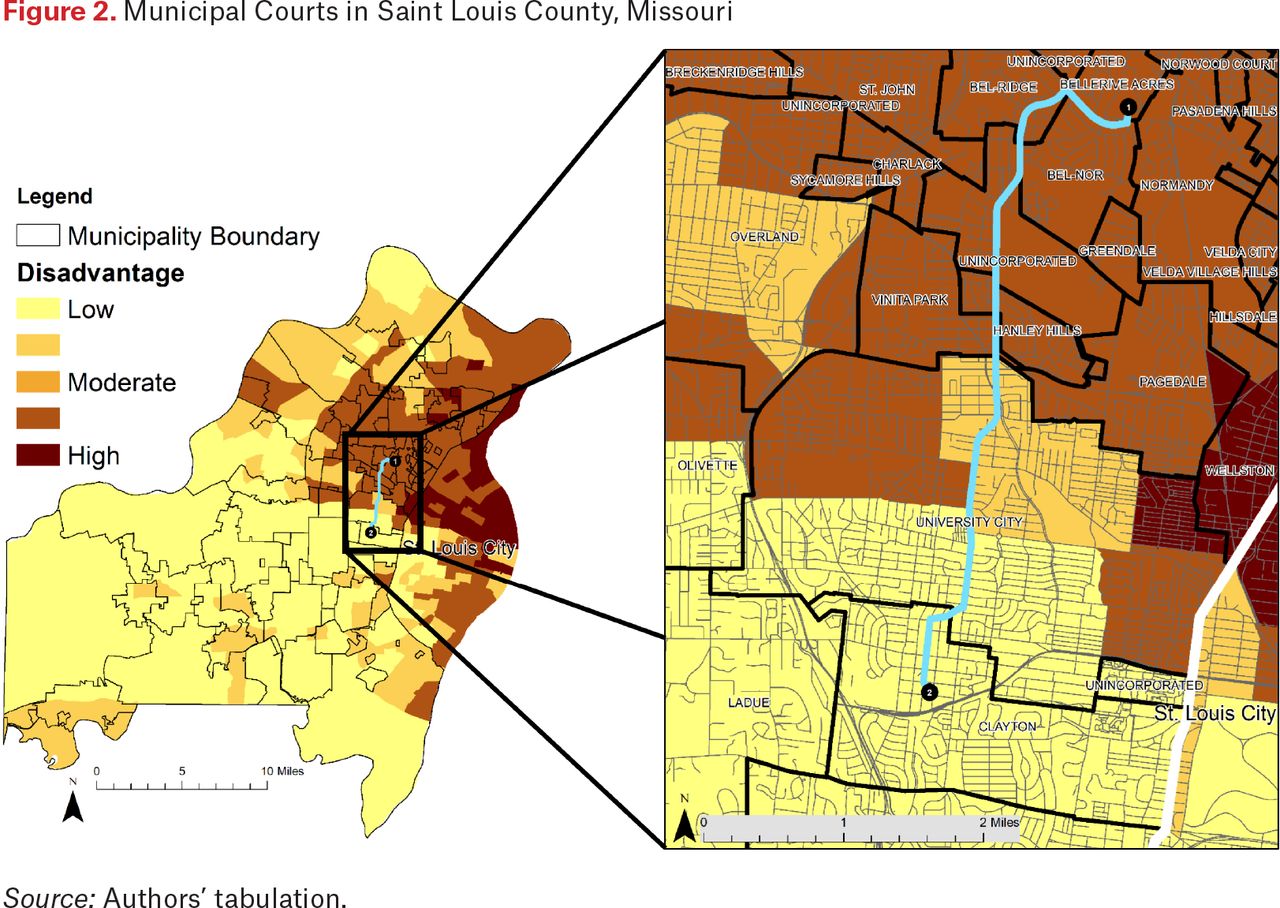

Reinforcing The Web Of Municipal Courts Evidence And Implications Post Ferguson Rsf The Russell Sage Foundation Journal Of The Social Sciences

Missouri Shoppers Say Show Me Sales Tax Free Items Don T Mess With Taxes

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Fourth Quarter 2020 Taxable Sales Nextstl

Property Tax Webster Groves Mo Official Website

Construction Set To Begin On Long Awaited Police Precinct In South County St Louis Call Newspapers